£20 cut to Universal Credit will push families into poverty

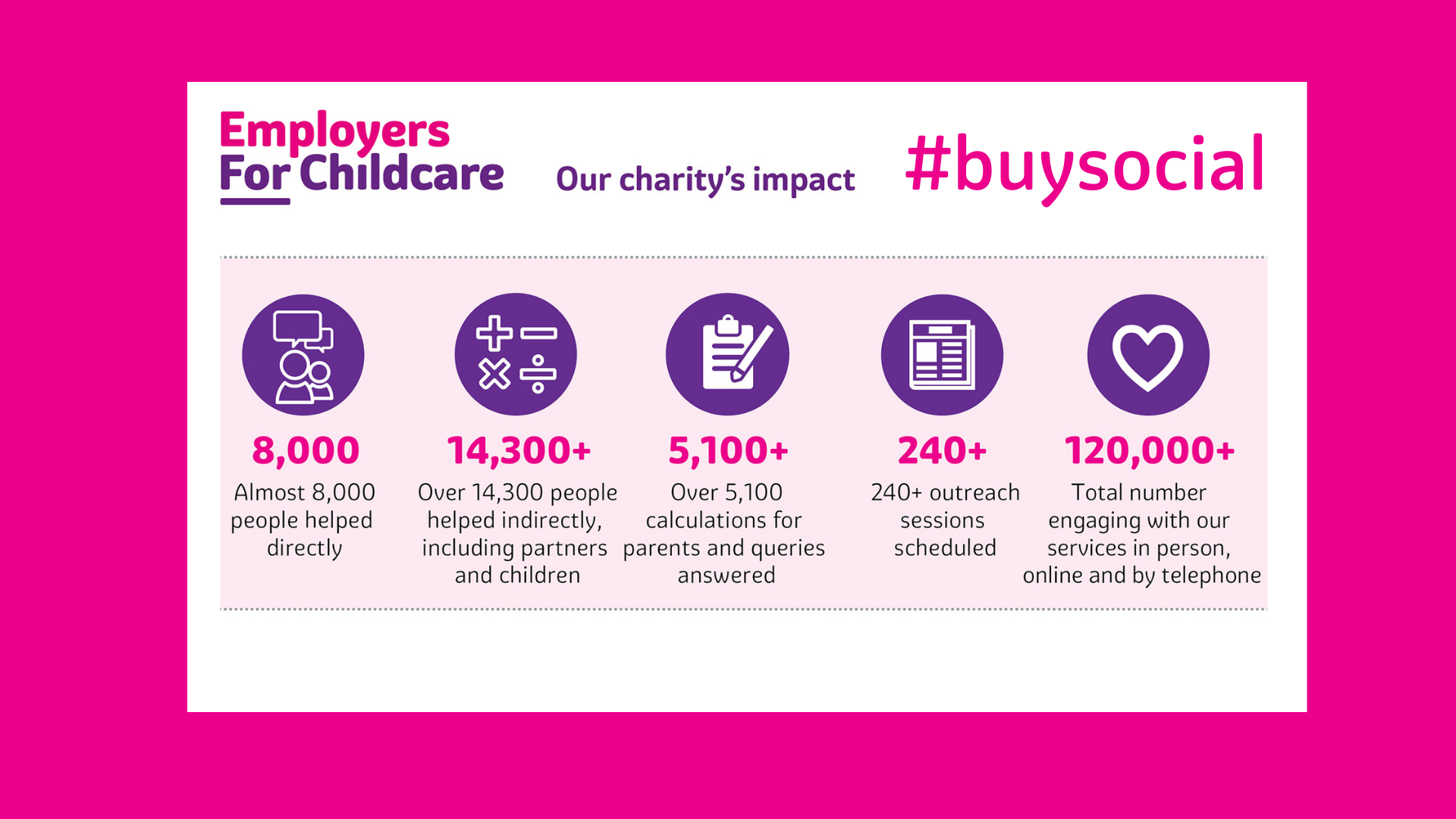

The looming £20 per week cut to Universal Credit has been a hot topic both in Parliament and in the media over recent weeks and months, with charities, academics and MPs from all sides (including within the Conservative party) calling on the Government to reverse its decision and ‘keep the lifeline’. On a daily basis, our charity’s Family Benefits Advice Service is supporting families who rely on Universal Credit as an essential part of their household income, and are struggling to work out how they will make up the weekly shortfall.

Why is Universal Credit being cut?

In March 2020, a £20 per week uplift in Universal Credit was introduced to help households cope with the negative effects and financial pressures caused by the Covid-19 pandemic.

The Government has argued that this was always intended as a temporary measure, and has reaffirmed its decision to end the uplift from October 2021 – coinciding with the end of the furlough and self-employment income support schemes, as well as the ongoing easing of Covid-19 restrictions.

However, it is clear that we are still in a very different economic situation than we were prior to Covid-19. The inflation rate is showing that household costs for goods and services are rising at a much higher rate than they were pre-pandemic. Global energy costs are forcing up household utility bills, the weekly grocery bill has increased significantly, as has the cost of filling up a vehicle with petrol or diesel. In Northern Ireland, in addition to these outside pressures, there are still many sectors of the economy – including large and small employers – which are unable to open up fully due to some remaining restrictions or, for some, the inability to source all the products they need from suppliers due to Brexit related issues.

In addition, the furlough scheme which has been supporting employers and employees will be closing from the end of September. The latest available data, from July 2021, showed there were still 36,000 workers in Northern Ireland whose jobs were being supported through this scheme, and it remains to be seen if those workers return to the workforce as they are likely to mainly be in the industries affected by the long-term impact of the pandemic.

Who will be affected by the cut to Universal Credit?

In Northern Ireland there are more than 116,000 households in receipt of Universal Credit. 42% of these are families with at least one child. Almost a third of Universal Credit claimants are people who are in work, while more than a third are those who are not expected to work, for example due to health reasons or because they have caring responsibilities which prevent them from working.

Each of these households will be worse off by £20 per week – equating to over £114 million lost from the Northern Ireland economy over the next 12 months. For families, that means over £80 a month wiped from their household budget at a time when, as set out above, the cost of living is going up.

Can claimants simply make up the £20 by working more hours?

While members of the Government have suggested that the cut to Universal Credit could be offset through simply working a couple of extra hours at minimum wage, this shows a fundamental lack of understanding of how the Universal Credit system works.

Firstly, the ability or opportunity to work extra hours, and be paid for them, is not within the control of the employee, but rather this would have be agreed by an employer who may not be willing or able to do so. Alternatively, it may require the individual to find an additional job, or move jobs, which some will find difficult, while others will be hesitant to move jobs in the current climate if they are in secure work.

Secondly, if a Universal Credit claimant increases the hours that they work and, as a result, receives more pay, their Universal Credit claim will be reduced. This means that, even if they were earning close to £10 an hour, it would take more than two hours to make up the shortfall of £20 per week as for every extra pound they earned, their benefit payment would be reduced by 63p. This is because, for those on Universal Credit, the more they earn through work (above an in-work allowance), the less Universal Credit they will receive.

The Resolution Foundation has calculated that an employee who is on the National Living Wage, and earning £8.91 an hour (if over 23), would have to work an additional nine hours per week in order to make up the £20 cut to Universal Credit.

Resolution Foundation calculation:

Income: £8.91 per hour

Minus:

- £1.78 Income Tax

- £1.07 National Insurance

- £3.82 Universal Credit taper

Take home: £2.24 per hour.

This is reflected in our own calculations, having recently provided tailored advice to a single parent of one child, currently working 16 hours per week at £8.91 per hour and paying for registered childcare.

We calculated that our client would need to work at least 25 hours a week, and therefore also have to pay for a minimum of 9 additional hours of registered childcare, in order to take home enough money each week to offset the loss of the £20 Universal Credit.

Assuming the parent’s employer is able to give her an extra 9 hours’ work, and that there is availability at her childcare provider, she will be effectively working for just over £2.20 per hour – and that is before taking into consideration any additional costs associated with working those extra hours such as commuting and parking.

How many people would be willing to work for just over £2 per hour?

We are here to help

All these factors combine to make the coming months a very challenging time for parents. It has been referred to as a ‘perfect storm’ of rising outgoings, decreasing income, and for many households very little prospect of being able to mitigate against these outside pressures. Now more than ever it is very important that you are sure you are claiming all forms of financial support your family may be entitled to.

If you are concerned about this cut to Universal Credit or wish to find out more about what financial support you may be entitled to, contact our Family Benefits Advice Service and one of our skilled advisors will be able to give you a personalised calculation. For free, impartial and confidential advice call us on Freephone 0800 028 3008 or email hello@employersforchildcare.org

Campaigning to ‘keep the lifeline’

Rather than going ahead with this cut to Universal Credit, we are calling on the Government to ‘keep the lifeline’ and to extend it to those who are on ‘legacy’ benefits and who have so far been left out, such as those on Income Support, Employment and Support Allowance or Job Seekers Allowance.

You can add your voice to the campaign by writing to your MP, sharing your concerns about the cut and asking them to choose to protect people and families when they need support. For further information, and a template letter which you can use and personalise, visit the Joseph Rowntree Foundation website.