Am I entitled to Universal Credit?

Universal Credit is a complicated benefit. It is designed to give financial support to many different types of families and individuals, with a range of different circumstances. It supports people who are working, as well as those who are unable to work or are looking for a job. It has different ‘elements’ so as well as a basic amount it can also help with things like registered childcare costs. It has been designed to try to ensure people are always better off in work than out of work and aims to support people to work more hours, with the level of benefit received gradually decreasing in line with hours worked.

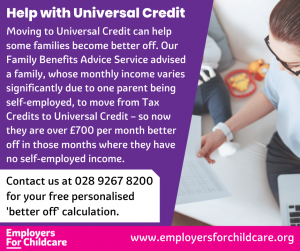

It can be complex and confusing to work out what support you are entitled to – so to find out if you are eligible for Universal Credit – and how to make your claim – the best thing is to have a chat with an experienced benefits advisor. Employers For Childcare’s Family Benefits Advice Service is here to help, providing free, confidential advice. Our team is available on 028 9267 8200, or email hello@employersforchildcare.org to advise on what is best for you and your family.

Can I claim Universal Credit?

To claim Universal Credit you must:

- be at least 18 years old and under pension age (but see below for 16 and 17 year olds)

- not be in full-time education (in most cases, but see below information for students)

- be in the UK

- not have savings or capital over £16,000

- have accepted a claimant commitment.

See below for more detail on each of these criteria.

So, what is Universal Credit?

Universal Credit is a means-tested benefit for people of working age, who are either working, but on a low income, or are out of work. It includes support for the cost of housing, children and registered childcare. For example, whether you are a lone parent, or sick or disabled, a carer, unemployed or in low paid work and need help with living expenses, including your rent, the means-tested benefit you will claim will be Universal Credit.

The old benefits replaced by Universal Credit, known as legacy benefits, are:

- Child Tax Credit

- Working Tax Credit

- Housing Benefit

- Income-related Employment and Support Allowance

- Income-based Jobseeker’s Allowance

- Income Support

- Parts of the Social Fund (Northern Ireland only).

What if I am receiving one of the old benefits – can I claim Universal Credit?

Yes, you can move from a ‘legacy’ benefit to Universal Credit however, depending on your circumstances, it may or may not be beneficial for you to do so. You will lose entitlement to any of the legacy benefits you currently receive if you claim Universal Credit, and will not be able to go back on to them. One of our Family Benefits Advisors can complete a check for you to identify what form of support if best for you.

If you experience a change in your circumstances you may find you are moved to Universal Credit as a result of the change. For example if you are single and claiming legacy benefits, if you were to move in with a partner this could result in you both having to claim Universal Credit as a couple. This is known as natural migration.

Not all changes of circumstances will result in having to make a new claim for Universal Credit. We strongly advise in any change of circumstances that you seek advice before making a claim for Universal Credit as it may not be the best option for you or your family.

If you currently receive any of the legacy benefits that are being replaced by Universal Credit and have no change in circumstances you will be transferred to Universal Credit at some point in the future. You will be contacted by the Department for Work and Pensions or the Department for Communities (Northern Ireland) when it is time for your claim to move to Universal Credit. At present this has been delayed, though was planned to be completed by September 2024. It is unclear what impact the Covid-19 pandemic will have on the overall timetable.

What if I am aged 16-17 years old?

You may be able to get Universal Credit if you are aged 16 or 17 if you:

- have dependent children

- are sick and satisfy the work capability assessment or are awaiting assessment

- are caring for a severely disabled person

- are pregnant (between 11 weeks and the expected due date) or have recently had a baby (up to 15 weeks after the birth)

- are without parental support.

What if I am a student?

You will not normally be able to claim Universal Credit if you are:

- in non-advanced education and someone can claim the child element of Universal Credit for you

- in advanced education

- a full-time student supported by a loan, grant or bursary

- undertaking any other course that is not compatible with your expected hours of work or any work-related requirements.

You will be able to claim as a student if you:

- have dependent children or young persons

- are a foster parent

- are a disabled student

- have a partner who is entitled to Universal Credit

- are over the qualifying age for pension credit and you have a partner who is entitled to Universal Credit

- are in non-advanced education (up to age 21 or the end of the academic year/ course in which you reach age 21) and have no parental support.

If you have a partner and one or both of you is in full-time education you will have to make a joint claim for Universal Credit.

What if I or my partner is over Pension age?

Pension Credit gives you extra money to help with your living costs if you’re over State Pension age and on a low income. If you are part of a couple and one member of the couple is over Pension Credit age and the other is under, you will only be able to claim Universal Credit – not Pension Credit. Couples will only be able to begin claiming Pension Credit if BOTH partners are over Pension Credit age.

What does being ‘in the UK’ mean?

To claim Universal Credit you must:

- be present in the UK

- be habitually resident

- have the right to reside.

Do not apply for Universal Credit if you have a visa that says “no recourse to public funds” or you’re subject to immigration control. This could affect your right to stay in the UK.

What does the Savings or Capital Rules mean?

The savings or capital limit for Universal Credit is £16,000 whether you are single or part of a couple making a joint claim. This means that if you have savings or capital over £16,000, you cannot get Universal Credit.

If you have savings or capital over £6,000, but less then £16,000, this will be treated as giving you an income, known as “tariff income”, of £1 per week – or £4.35 a month – for each complete £250 over £6,000. If it is not a complete £250, it is rounded up to the next £250.

For example: If you have capital of £6,300, your Universal Credit will be reduced by £8.70 a month (£4.35 multiplied by two) until a time when the value of your capital has reduced to £6,250 or less. When your capital is £6,250 or less, your Universal Credit will be reduced by £4.35 a month until the value of your capital is £6,000 or less.

If you have savings or capital under £6,000 this will be disregarded.

Capital and savings do not include the home you live in, or any occupational and personal pensions.

What is a ‘Claimant Commitment’?

A Claimant Commitment means that you have responsibilities when you are in receipt of Universal Credit. These are set according to your individual capability and circumstances. You will be placed in one of four groups which specify your responsibilities while you are in receipt of the benefit:

- no work-related requirements

- work-focused interview requirement only

- work preparation requirement

- all work-related requirements.

If you fail to meet your claimant commitment without good reason, you may receive a cut in your benefit, known as a sanction.

How can I find out how much Universal Credit I will receive?

Universal Credit requires a complicated calculation to arrive at your entitlement so you should always seek advice from a benefits advisor.

Universal Credit is a ‘means tested’ benefit, therefore you will be awarded an amount based on your household income and family circumstances.

The total award you get is made up of amounts you are entitled to due to your household circumstances, from this an amount is deducted depending how much your household income is from employment.

As household circumstances and incomes vary greatly so does entitlement to Universal Credit. For detailed information on the allowances and elements that make up an award and how earnings and other income can affect your entitlement see our Universal Credit factsheet.

See below for some examples of families who have benefited from claiming Universal Credit