Backdating Childcare Vouchers explained

Reminder: If you haven’t used all of your annual entitlement to Childcare Vouchers you may be able to save more money before the end of the tax year!

Childcare Voucher savings are based on an annual entitlement. Some employers allow staff who have not reached their annual entitlement to sacrifice more of their salary, tax and National Insurance free, before the end of March 2021, to use at a later date.

What is backdating?

Backdating allows parents to retrospectively claim their full entitlement to Childcare Vouchers if they have been salary sacrificing less than their full allowance per month throughout the year. This may be the case for many parents this year, due to reduced access to registered childcare during the early months of the Covid-19 pandemic, when we know some parents reduced the amount they were paying into their Childcare Voucher accounts, or for those who have been on furlough.

Example

A basic rate taxpayer is allowed to sacrifice up to £243 per month, that’s up to £2,916 in the year to the end of March 2021. If you have been sacrificing £200 per month from April 2020 to December 2020 (totalling £1,800) you could, if eligible, sacrifice an additional £516 (£43 x 12 months) spread over the remaining three months of the tax year in addition to the £200 regular monthly sacrifice.

If your employer allows you to backdate then your salary deductions for the next three months will need to be amended through your payroll.

It’s important you speak to your employer now to find out if you can backdate your Childcare Vouchers for 2020/21 and, if so, what the process is as it could take some time to process your request.

Please note:

- Backdating is at the discretion of your employer – some employers do not permit employees to backdate Childcare Vouchers.

- We recommend your salary does not drop below £1,042 per month once all deductions have been made – including Childcare Vouchers – otherwise you may not be making any savings on your income tax or National Insurance Contributions.

- Basic rate tax payers can sacrifice a maximum of £2,916 to the end of March 2021.

- Higher rate tax payers can sacrifice a maximum of £1,488 to the end of March 2021.

- Additional rate tax payers can sacrifice a maximum of £1,320 to the end of March 2021.

Note, if you are currently on furlough then any salary that you sacrifice must come either from your full pay for hours worked, if you are on flexible furlough, or from an employer top up of your furlough pay, if applicable. This may be complex to work out, so please call our Family Benefits Advice Service for guidance if this applies to you.

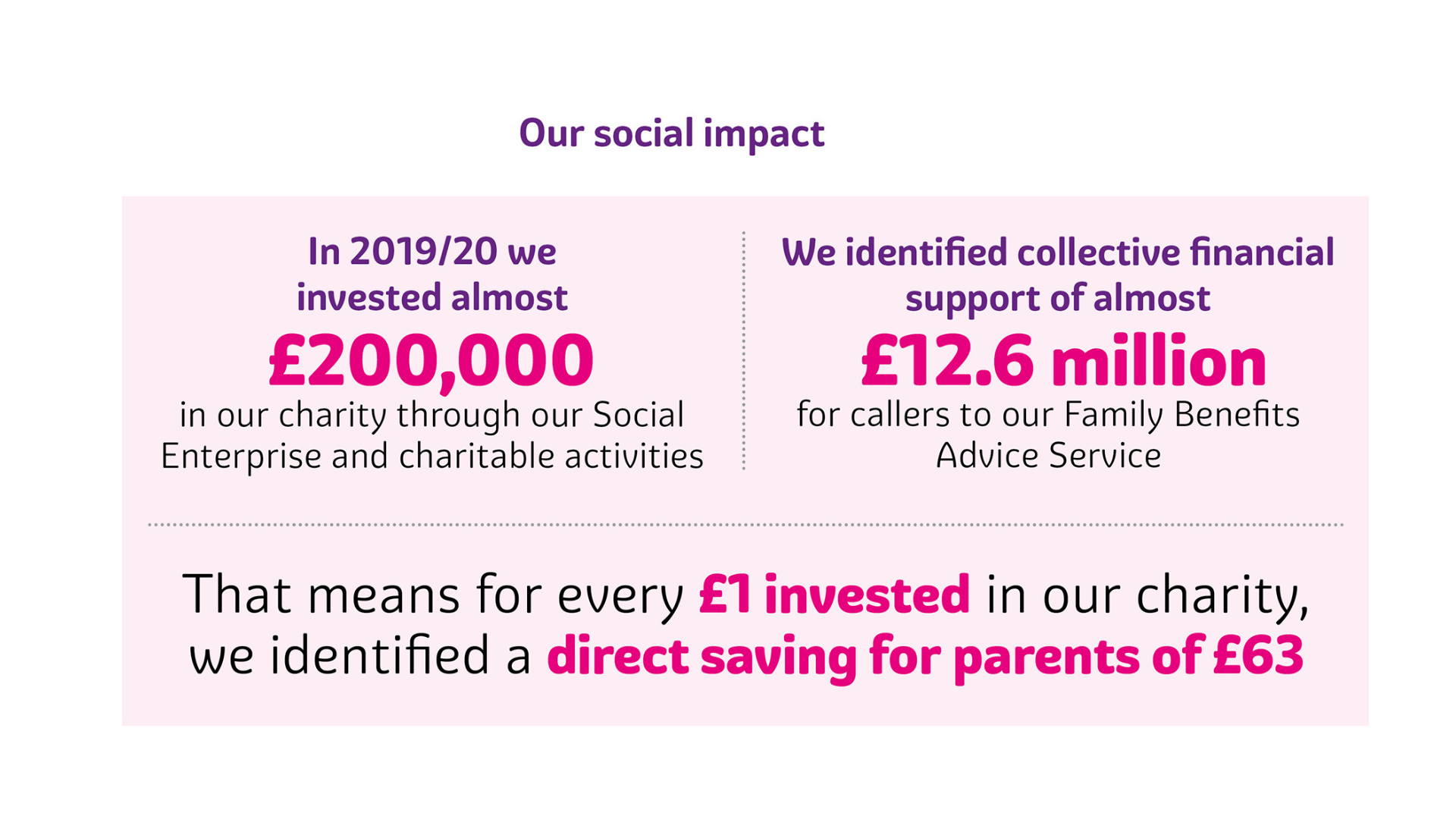

Family Benefits Advice Service

If you have any questions about backdating, or Childcare Vouchers more generally, call our Family Benefits Advice Service for free, impartial and confidential advice on 028 9267 8200.

Chris Briggs from Employers For Childcare's Family Benefits Advice Service explains how both employers and their employees can maximise the financial savings they make through the Childcare Voucher scheme by 'backdating'. Chris explains the rules around backdating and signposts to where employers and parents can access further information.