How do Childcare Vouchers work?

At a glance!

- Employees exchange part of their pre-tax salary for Childcare Vouchers

- The full amount is exempt from tax and National Insurance meaning the employee can save up to £933 per annum

- The employer also saves on employer’s National Insurance Contributions

- Parents have an online Childcare Voucher account which they can use to make payments to their registered childcare provider.

How do employees save money?

Childcare Vouchers typically operate through salary sacrifice. A salary sacrifice arrangement is an agreement by an employer to reduce an employee’s cash pay, usually in return for a non-cash benefit. Under the Childcare Voucher scheme employees may ‘sacrifice’ part of their pay in exchange for Childcare Vouchers. This is done pre-tax, meaning that employees save money on tax and National Insurance Contributions. Childcare Vouchers can only be used to pay for registered childcare.

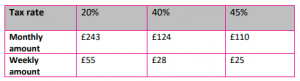

Each eligible parent can sacrifice a maximum of £243 per month (this depends on their tax band) from their salary into their Childcare Voucher account, saving them £77.76 each month – up to £933 in a year. This helps working parents to make a saving on what they pay for their childcare.

The amounts that employees can salary sacrifice, depending on their tax rate, are set out below:

(Note the tax bands are different in Scotland see https://www.gov.uk/scottish-income-tax for further information).

In most cases, employees manage their Childcare Vouchers through an online account, which they use to pay their childcare provider electronically. The portion of their salary which they have ‘sacrificed’ is automatically paid into the account, by their employer, usually through a third party Childcare Voucher company.

How do employers save money?

Employers also save money by providing Childcare Vouchers to their employees as they do not pay the 13.8% employer’s National Insurance Contributions on the salary their employees have paid into their Childcare Voucher accounts. From this saving, most employers pay a Childcare Voucher company, like Employers For Childcare, a small fee to administer the Childcare Voucher scheme on their behalf.

How much parents and employers saved by using our Childcare Vouchers in 2019/20

What is the impact of the changes to National Insurance?

In September 2021 Prime Minister Boris Johnson announced a 1.25% increase in National Insurance Contributions from April 2022 as part of a new health and social care tax to fund reforms to the care sector and NHS funding in England. The increase will be paid by employees, the self-employed and by employers.

As a result of this increase to National Insurance Contributions, parents who are currently in receipt of Childcare Vouchers will make an additional saving towards their registered childcare costs from 2022. At present, a basic rate taxpayer who salary sacrifices £243 each month makes an annual saving of £933. From April 2022, this will increase to £970 per year.

Employers will also make a greater saving on Employers’ NICs when the increase comes into effect.

But aren’t Childcare Vouchers closed?

The Government closed the Childcare Voucher scheme to new entrants in October 2018, but those parents who were already using the scheme can continue to do so as long as they remain eligible. This means they must:

- Stay with the same employer

- Make at least one payment into their account every 52 weeks

- Not leave the Childcare Voucher scheme to join Tax-Free Childcare

- Have a child under the age of 16 (17 if the child has a disability).

Employers can continue to provide the scheme to their employees but cannot accept any new employees to ‘join’ their scheme. Employers have the option of ‘switching’ by moving their Childcare Voucher scheme to a new provider if they choose to do so. This switch of provider has no effect on their employees’ eligibility to remain in the scheme.

Why choose Employers For Childcare?

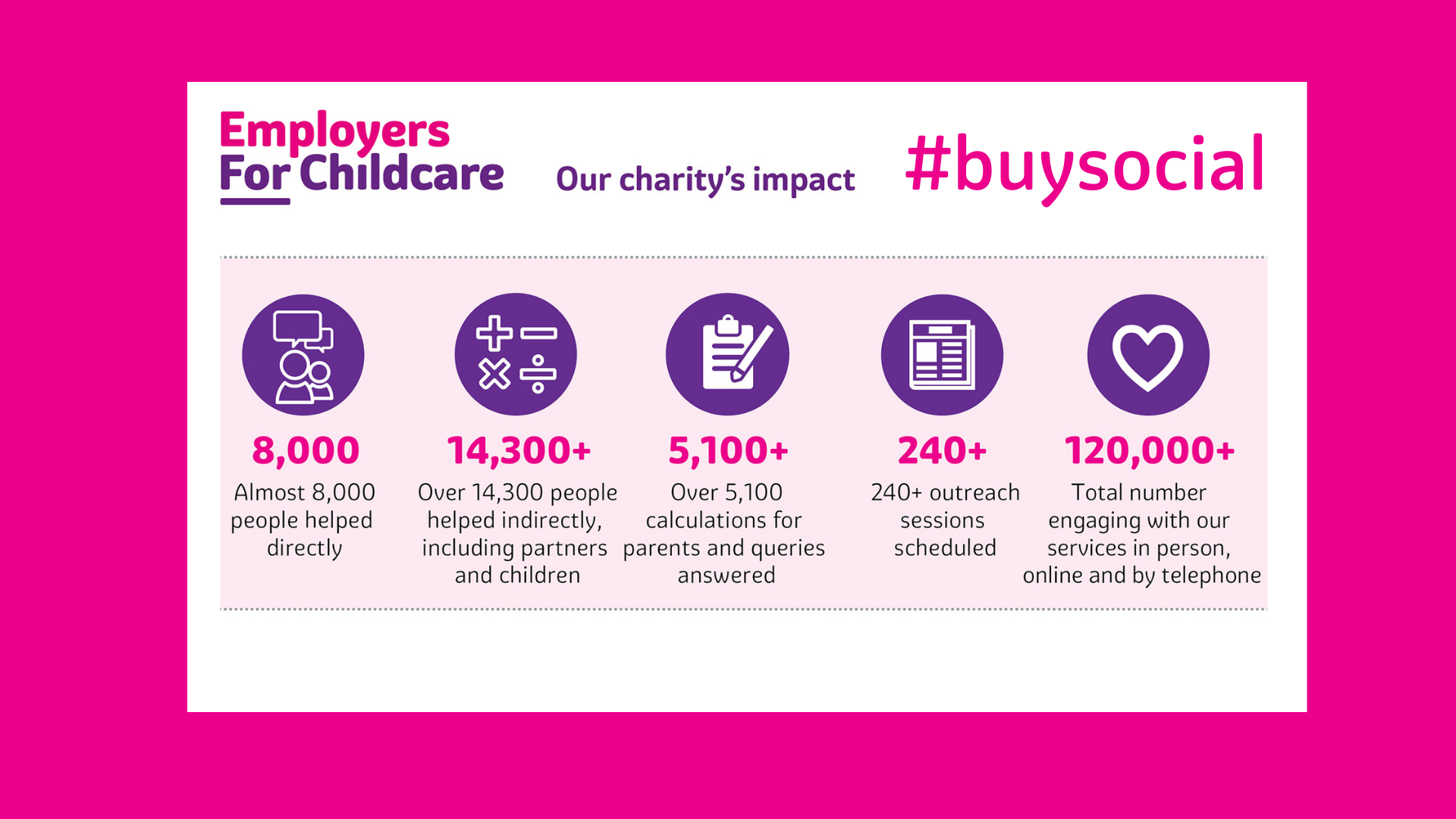

Employers For Childcare is one of a number of Childcare Voucher companies operating in the UK, but is the only Social Enterprise which provides this service. This means 100% of the profits that we make from administering Childcare Vouchers on behalf of employers is invested in the work of our charity, which supports parents across the UK to get into and stay in work by identifying the financial support they are entitled to towards their childcare costs. By choosing to ‘buy social’ and switch their Childcare Voucher scheme to Employers For Childcare, organisations are using their purchasing power to help us create social value. Last year, our charity identified over £12.6 million in financial support for parents, having directly helped over 8,000 people.

As well as ‘buying social’, organisations who choose to move their Childcare Voucher scheme to Employers For Childcare benefit from our exceptional customer service and can also save money through our competitive administration rates. You can read more on our latest Customer Satisfaction Survey here.

The process of switching is easy, it usually can be done in a matter of days and our dedicated team is on hand to support employers who choose to make the switch. One employer who switched recently told us: “The switching process was very easy and straight forward and as well as knowing we are creating social value by working with a Social Enterprise, we also saved money through switching. A real win-win!”

For a competitive quotation, tailored to your business, get in touch by emailing hello@employersforchildcare.org or call us on 028 9267 8200.