Using an unregistered childcare provider can be an expensive mistake

Our team at Employers For Childcare sometimes receives calls from parents who are using an unregistered childminder to look after their children while they work.

Usually, this is because the parents think this will be a less expensive option. However, because the majority of working parents are entitled to financial support with their registered childcare costs, this is not the case.

Parents may also be unaware that it is a legal requirement for anyone who is looking after children for more than two hours a day, for reward, to be registered.

Here are just some of the reasons it makes sense to use a registered childcare provider:

- Cost: Parents are only able to get financial support with their childcare costs if they are using a registered or approved provider.

- Standard of care: Registered childcare providers are regulated and inspected, and must comply with minimum standards of safety and numbers of children.

- Safety: Registered childcare providers must be vetted, and have appropriate training and qualifications, for example in paediatric first aid. They will also have relevant policies, procedures and insurance in place to ensure that they and the children they care for are protected.

Registered childcare providers will be happy for parents to view their insurance and inspection certificates and to provide their policies and procedures.

You can find out more on the Family Support NI website.

If you are currently using an unregistered childcare provider, speak to them today about becoming registered. If they refuse to do so, you can find a list of all registered childcare providers in your area on the official childcare register for Northern Ireland.

It is important to note that an unregistered childminder is different to using informal childcare. Informal childcare is valuable, trusted care provided by grandparents and close family or friends. Unregistered childcare is provided by those who are not formally registered but who charge a fee for their services and is not permitted under the Children (NI) Order 1995.

Case study

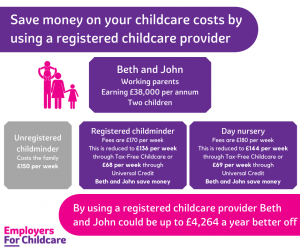

Beth recently called our Family Benefits Advice Service. Beth was using an unregistered childminder at a cost of £150 a week. She chose to do this because it was less expensive than a local registered childminder she had contacted (£170 a week) and a local day nursery (£180 a week).

Beth lives with her partner John, and they have two children aged 3 and 1. They are homeowners, and both are working with a joint annual income of £38,000. By using an unregistered childminder, the family is unable to access any support towards their childcare costs.

If Beth and John were using a registered childcare provider, they would be eligible for financial support towards the cost of their childcare through both the Tax-Free Childcare scheme and Universal Credit.

Tax-Free Childcare is a Government support scheme which would save Beth and John 20% of their registered childcare costs – reducing the registered childminder costs to £136 a week, and the day nursery to £144 per week (both less than what they are being charged by the unregistered childminder).

Universal Credit is a means tested benefit, the amount paid depends on household income and circumstances, and can include support towards registered childcare. If Beth and John were using the registered childminder charging £170 per week they could receive £102 per week from Universal Credit towards the cost. If they were using the day nursery charging £180 per week they could receive £111 per week through Universal Credit. This would reduce their weekly outgoings on childcare to either £68 or £69 respectively (again both much less than they are paying to the unregistered childminder).

In each case, Beth and John are financially better off using the registered childcare provider rather than the unregistered childminder.

By using a registered childcare provider Beth and John could be up to £4,264 a year better off.

Find out what financial support your family can benefit from

If you are paying for registered childcare remember that most working parents are entitled to financial support with the costs. With a number of different schemes available, it can be complex working out what financial help your family is entitled to with childcare. Our advisors can help you work out what the best childcare support is for you.

Simply call our Family Benefits Advice Service on Freephone 0800 028 3008 for free, confidential and impartial advice from one of our trained advisors. We will explain all of your options, and tell you why one or other form of support is better.

Last year, our advisors identified an average of £2,800 in financial support for parents who contacted the Family Benefits Advice Service for a personal calculation – so it is definitely worth the call!